SAMT Blog

TA articles and studies

searching for the ideal stop

ATAA 2024 Conference Online

Bertschis Chart Outlook and SPECIAL OFFER

iShares China Large Cap very bullish reaction

IFTA Update September 2024

2 clear bearish market correction signs you ignored

IFTA 2024 conference in Hainan, China

IFTA Update June 2024

MACD-v: Volatility Normalised Momentum - A Twice [...]

Una giornata di formazione a 360 gradi

The Roadmap from 2024: Harnessing Super Cycles

IFTA March 2024 update

Un’ottima performance (ma preoccupante)

An excellent (but worrying) performance

IFTA Journal 24 - now available

Martin Pring's 2024 Equity Market Outlook

S&P500 - Weekly Charts and potential outlooks for 2024 [...]

S&P500 and Euro$ - Monthly Charts to Nurture the 2024 Debate

Attenzione a Yellowcake

Beware of the Yellowcake

IFTA Update December 2023

Risk-on: quanto può durare?

Risk-on: how long can it last?

"Santa Claus Is Coming To Town"?

Tradingview - Black Friday Sale

"This is gold, Mr. Bond"

Long-term yields drive a potential risk-on phase

I tassi a lungo termine guidano una potenziale fase risk-on

IFTA Update September 2023

Stock sectors and relative strength: an analysis with [...]

Settori azionari e forza relativa: un'analisi con i [...]

Crude Oil: A reawakening for Inflation & Group Think?

S&P500-Reversal risk in summer

Health Care: un settore da seguire

Health Care: a sector to watch

SAMT Zurich and Geneva event - presentation handouts

The Perils of "Painting the Tape"

IFTA June 2023 update

S&P500 entering weaker season May-October

How Investors Can Take Advantage of Seasonal Trends [...]

Gold to consolidate before climbing to $2800

The US$ Index Turns Down Along the Cloud!

IFTA Update March 2023 update

Trend and Volatility Strategies

Kommt jetzt die große Korrektur beim DAX?

GOLD : too early to buy

market analysis - presentation handouts

S&P500 in uptrend

Mastering Trading Psychology

IFTA Journal January 2023 update

Will lightening strike twice?!

How to Use ADX and MACD Together

Expect a Triangle Pattern for Months in US 10-Year [...]

Webinar: Wyckoff Workshop with 6 presentations

IFTA Journal 23

Swiss Market Index SMI With A Possible Temporary Low

Bertschis CHART OUTLOOK SWISS EQUITIES

Trade With A Plan

Trader Essentials - Business Shirts

IFTA September 2022 update

S&P500: to hedge or Not to hedge

Wyckoff Workshop with 4 presentations!

EUR/USD Parity: A Clear & Present Reality?

Seasonality patterns re-align

IFTA Update July 2022

S&P500: 3 bubbles - where is the bottom?

CFTe Digital Badges from IFTA

Aumentano le evidenze di un'inversione della tendenza [...]

Growing Evidence that the Secular Trend in Equity [...]

IFTA global conference 2022 in Melbourne, AU

S&P500: 2022 still Low of the Four-Year Cycle due Later

Buy Strength or Buy the Dip?

Comprare nella forza del mercato o nei ribassi?

Improving on ETFs: Get Higher Returns with Lower Risk

Come migliorare gli ETF: ottenere rendimenti più alti [...]

Il nuovo mondo delle obbligazioni

The new world of bonds

SAMT and NDR breakfast events

IFTA Update March 2022

Bitcoin: BTCUSD 100k or 10k? UPDATE

BTC: forecast for 2022, considering the fundamental [...]

Telling the Truth After 12 Years of Trading

Crypto Markets and the Wyckoff Method: A Top-Down Approach

A Chartists View of the Markets in 2022

Martin Prings 2022 Market Outlook

BTCUSD: 100k or 10k?

IFTA South East Asia Webinar Collaboration Market [...]

IFTA Update January 2022

TEST TEST TEST diNapoli levels on the SMI

What Smoking Weed and Investing in The Stock Market [...]

2022 Global Outlook by NDR Research

Bitcoin: buy the dip!

GBPUSD Asymmetric Risk

job opportunity - Junior Technical Analyst

10 Key Asset Allocation Questions into Spring 2022

IFTA magazine by Connie Brown

IFTA Journal 22 available

Introduction to Technical Analysis

IFTA Update September 2021 - now available

Dr. Copper's delicate condition

La delicata situazione del dottor Copper

Healthcare & Biotech

Farmaceutico & biotecnologie

US 10Treasury Yield: About to Give Signal for Sharp Rise ?

Oil running low on energy

IFTA webinar: Trend Following - A Complete Edge for [...]

IFTA webinar: Trend Following - A Complete Edge for [...]

How to trade CFDs

IFTA Update June 2021 - now available!

IFTA Webinar: The Case for 2021 Harnessing Super Long [...]

Post-Pandemic Outlook From A Chartists Perspective

A new check on China & USA stock markets

Un nuovo confronto tra mercato azionario americano e cinese

9 examples of practical technical analysis

Is Gold's trend still your friend?

The Unger Method

Trading with Footprint Charts

Resumption of Downtrend for US$ Index!

SAMT Webinar: Elliott Wave Analysis – As applied to [...]

IFTA Update March 2021 - now available!

Rolf Bertschi's Chartoutlook for Swiss Equities

Cina e USA

China & USA

March 2021 Market Outlook

rotation from Growth to Value

EURUSD: A Computer-Generated Model Applying Harmonic [...]

2021 Global Outlook & the Minsky Risk

S&P 500: è ora di una correzione?

S&P 500: is it time for a correction?

Equities extend higher into the Spring, perhaps next Summer

Gold -short term uptrend

SAMT Webinar: The Rising Star Ichimoku Strategy

IFTA Update December 2020 - now available!

La rivoluzione del Biotech

Biotech revolution

Actively Using Passive Sectors to Generate Alpha Using [...]

Not a major top for Nasdaq100

IFTA 2020 online conference - SPEAKER RECORDINGS available

2021 IFTA Journal - Now Available!

Interview with John Bollinger - Indexing for Technicians

S&P in the run-up to the presidential election

IFTA Update: September 2020 Issue - Now Available!

Swiss Trading Day 2020

IFTA, CFTe and MFTA Registration Information and Deadlines

Increase Your Profits Systematically With Recurring [...]

Three Steps to Better Decisions

Gold: Ready to make a break to $2400?*

Using Relative Strength to Capture Mega Trends

S&P 500: tendenze future

S&P 500: what's next?

Bitcoin (BTC): grow potential by the end of 2020

Gold & Silver

Oro e argento

S&P500: breve analisi del trend

S&P500: a brief trend analysis

3 technical analysis methods applied on S&P500

The Expander Strategy

Equity market crash: What next?

S&P 500: some hypothesis about the trend

S&P 500: qualche ipotesi sulla tendenza

Analisi grafica del Coronavirus e dei mercati fin.

Graphical analysis of Coronavirus and financial markets

Coronavirus e S&P 500: prime considerazioni

Coronavirus and S&P 500: first thoughts

Crush it With Clouds

Virus and financial markets

The year of metals

IFTA Update: December 2019 Issue - Now Available!

A short analysis of the MSCI Russia Index

Italian Mid Cap Stocks

Yield curve and stock market

Charting the value of technical analysis

Gold and Silver

A new focus on Chinese and USA equities

Defensive assets are topping out, for now

Equity markets short term trends: some considerations

IFTA Update: September 2019 Issue - Now Available!

Brexit trade idea | Long GBP/USD

GOLD: can the trend continue?

Benefit from Little Known Seasonal Patterns

Pay attention to Dr Copper

The fifth gold window

Bitcoin: some thougths

STOXX Europe 600 Utilities: a sector to watch

The battle between US and China stocks

Spread BTP-BUND in a new normal

EUR-USD: some thoughts

S&P 500: a matter of levels

How important is trading psychology?

SAMT Journal Winter 2017

The Socionomic Theory Of Finance – by Robert R Prechter

SAMT Journal Spring 2017

SAMT Journal Autumn 2016

SAMT Interview with Ian McAvity

Guide To Creating A Successful Algo Trading Strategy

SAMT Journal Spring 2016

SAMT Journal Autumn 2015

SAMT Interview with Bruno Estier

SAMT Interview with Robin Griffiths

SAMT Journal Spring 2015

Visual Guide To Elliott Wave Trading

SAMT Journal Autumn 2014

Tools And Techniques For Profitable Trend Following

SAMT Journal Spring 2014

SAMT Journal Winter 2013

Trading Beyond The Matrix – by Dr. Van K. Tharp

SAMT Interview with Hank Pruden

Trading Systems and Methods (Fifth Edition)

The Janus Factor - by Gary Edwin Anderson

SAMT Journal Summer 2013

SAMT Interview with Pring and Prechter

SAMT Interview with Robert Prechter

SAMT Journal Spring 2013

SAMT Interview with Martin Pring

Articles by James Touati

Trade ou pas Trade, le talkshow du trading

Chartist Triangles by The Wolf of Zurich

DEVENIR RENTABLE EN BOURSE

In France we don't have Oil, but

The Pullback by James D.Touati

GOLDFINGER: What's next? Italian version

BITCOIN-Larry Fink, Cathy Wood, and Clubber Lang are [...]

GOLDFINGER: What's next? Arabic version

BITCOIN-Larry Fink, Cathy Wood, and Clubber Lang are [...]

GOLDFINGER: What's next?

SPECIAL CRYPTOS - Please, STOP your bla bla

NATURAL GAS - analysis over 20 years

PSYCHOLOGY and SELF-CONFIDENCE when you trade

bearish signals on the EUR/CHF - what to look out for now

TOTAL (TTE) and WTI Crude Oil-New patterns detected

TOTAL (TTE) and WTI Crude Oil-New patterns detected [...]

NETFLIX-Important bearish patterns detected

GOOGLE-Bearish patterns have been detected

ICHIMOKU-6 points in 6 min (RU)

Special CRYPTOS for MEMBERS ONLY - Potential Reversal [...]

BITCOIN-Black Swan and Wolfe wave still valid

UBS The Bank-Special MORNING BULL (RU)

APPLE- Bearish Wolfe wave detected- Is a rebound possible?

3M (Weekly) -Wolfe wave detected - divergence - PRZ to [...]

UBS - bearish butterfly pattern detected

UBS "La banca" - speciale MORNING BULL (IT)

NASDAQ-Bearish Wolfe wave detected and targets estimations

UBS "La Bank": special MORNING BULL - (FR)

WTI Oil and Raw materials - can the drought in Panama [...]

UBS The Bank - special MORNING BULL

DOW JONES (H1) - bearish SHARK pattern and Wolfe wave [...]

SP500 "I believe I can Butterfly" (bearish)

UBS Group N - bearish Wolfe wave detected

DOW JONES - Wolfe wave detected (H4) and Head and [...]

EUR/CHF - bullish Wolfe wave pattern detected

DAX 40 / NASDAQ / SP 500 (M15) - bearish "Black Swan" [...]

KOTAK Mahindra Bank - a bearish Wolfe wave and a [...]

DAX40 - beautiful bearish GARTLEY detected - H1

NIFTY BANK - Wolfe wave detected

What is the ICHIMOKU indicator and how does it work? [...]

UBS Group AG - bearish Wolfe wave and trendline to monitor

DOW JONES - bearish Wolfe wave detected

SP500 - bearish GARTLEY detected

BITCOIN - Possible rebound in a short term?

NVIDIA with high earnings expectations and a bearish [...]

DAX 40 with an interesting GARTLEY pattern-is a [...]

FTSE: important trend line and Butterfly pattern to monitor

BITCOIN: two possible scenarios

SP500 (H1): very interesting GARTLEY patterns

MICROSFT peut rejoindre sa MME.200 en journalier?

Can MICROSOFT reach Its 200-day moving average?

TESLA on a major support - rebound or breakout?

TESLA sur un support majeur. Rebond ou cassure?

WTI Crude OIL: is a rise to 88.87 USD possible?

Pétrole brut WTI: une hausse à 88.87 USD est-elle possible?

NASDAQ broke Its 50-day moving average? Watch out!

NASDAQ: Cassure de la SMA.50 : Attention !

Does the semiconductor index start a new downturn?

L'indice des semiconducteurs commence t'il sa baisse?

NVIDIA peut rejoindre ses GAPs? Cassure d'importantes [...]

will NVIDIA reach its GAPs? Trendline broken downwards

AMAZON peut rejoindre son plus haut historique?

Can AMAZON reach Its highest level?? Is the PACMAN [...]

Apple entame-t-il une correction ?

Is Apple starting a correction?

Wolfe Wave pattern on CAC 40

DAX - a perfect Wolfe wave yet again

What is the SAMT?

The Swiss Association of Market Technicians is a non-profit organization of market analysis professionals and part of the international organization IFTA with sister societies in more than 20 countries around the globe. SAMT encourages the development of technical analysis and the education of the financial community in the uses and applications of research and its value in the formulation of investment and trading decisions.

What is technical analysis?

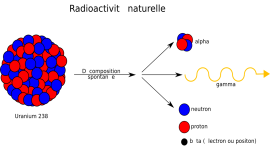

Technical Analysis is the study of price movement of financial securities and used as a methodology to forecast the direction of prices. It examines price behavior on an empirical and statistical basis and it extends to the study of all published information like past market data, primarily price and volume.

As part of our evolutionary DNA, our brain is hard wired for pattern matching, But ask yourself how you are applying this skill in your trading? As a trader, the ability to build an archive of pattern analogs can be very powerful.

Our Mission

The goal of SAMT is to introduce new members to the benefits of technical analysis, to educate them through valuable coursess as well as to teach existing members new analysis techniques and bring technical analysts together across Switzerland by organizing presentations and online webinars of leading market experts and excellent networking events. Our BLOG serves as the central hub for relevant news and posts.

Become a member

Enjoy our member bonus

Get access to our member area, so you are granted free admission to SAMT events and entitled for all benefits.

Join nowMeetings

Educational Discount

Resources

Networking

Journal

Updates

Education

Webinar Archive